The economist shared his forecasts on the housing market on his personal Facebook account.

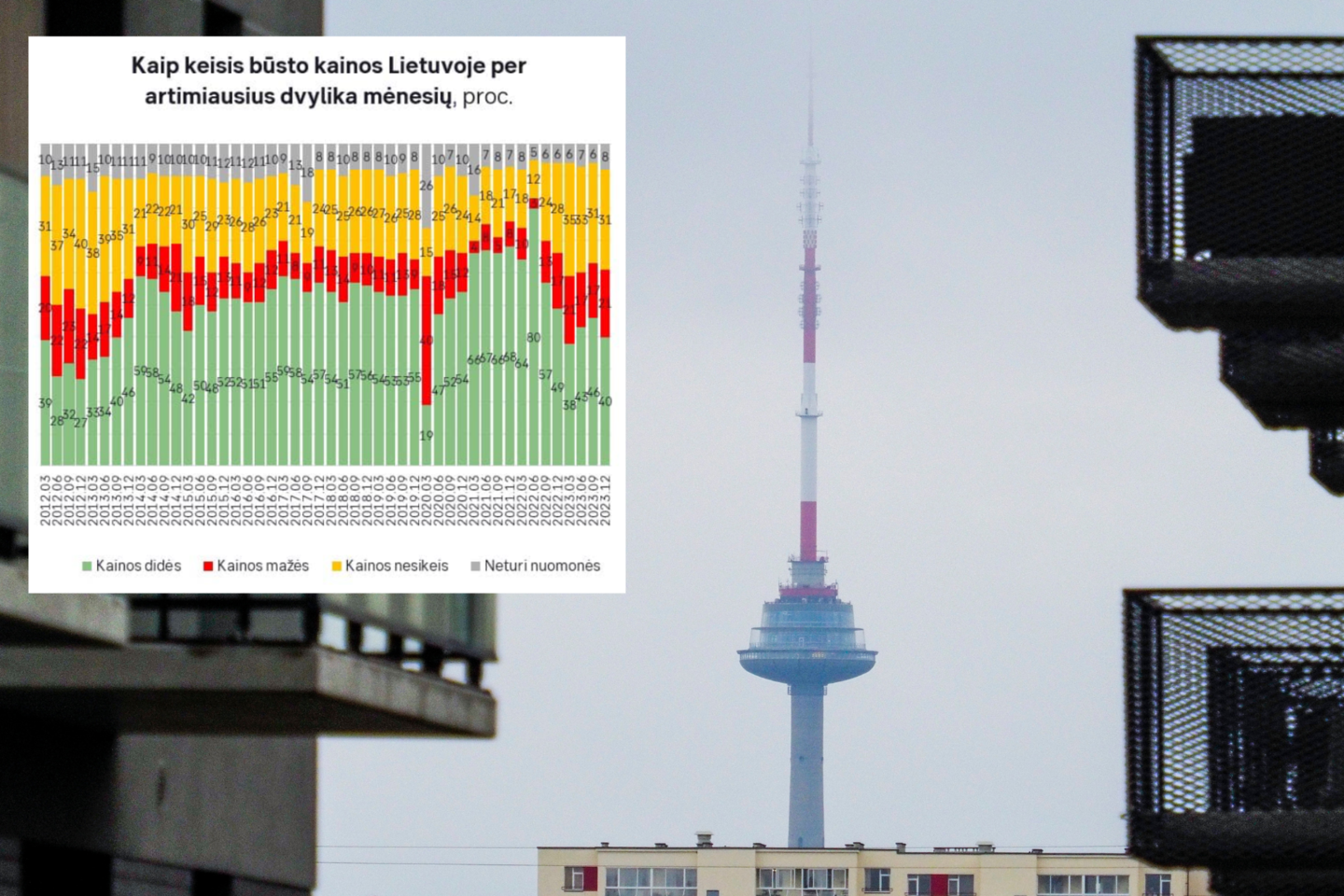

„A representative survey of the population conducted in December, which has been carried out for more than ten years by the company Baltijos Tyrimai on behalf of SEB Bank, showed that 40% of the surveyed population in Lithuania thought that the price of housing would increase over the next twelve months, 21% said that housing would become cheaper, 31% did not expect any major changes, and the remaining 8% did not have any opinion on the matter,“ the economist started his review. – The SEB Bank's House Price Expectations Index dropped to 19 points (calculated as the difference between the percentage of those who expect housing to become more expensive and cheaper).

A quarter ago, the index stood at 29 points. The lowest value of the index last year was in the first quarter when it was 17 points“.

It was noted that the deterioration in residents' expectations in the last quarter was most pronounced in the Vilnius region. In December, 35% of respondents expected higher house prices in the coming year, while 19% expected lower ones. A quarter ago, the corresponding figures were 46% and 17%. Expectations of Kaunas County residents have changed minimally – 40% thought that housing would become more expensive at the end of 2023, compared to 41% a quarter ago.

„Interestingly, at the end of last year, the most pessimistic about changes in house prices were managers, business owners and other self-employed persons. More people thought that housing would become cheaper in one year than those who thought that housing would become more expensive.

The housing market in the last quarter of 2023 was abysmal regarding the number of transactions. According to the Centre of Registers data, housing transactions were 8% lower than a year earlier or the most modest since 2012. Indeed, December was not as bad as November or October, but it is too early to say whether this indicates that the bottom of the transaction slump is behind us,“ said T. Povilauskas.

The Facebook post also gives an overview of the primary housing market.

He notes that the number of housing transactions on the primary market in the fourth quarter remained similar to the previous quarters of 2023, with an average of just under 200 units sold per month.

„On the one hand, the number of new housing transactions did not decrease last year, which should have reassured property developers. However, the number of transactions was historically low and did not make developers happy. As a result, the market saw significantly fewer new housing starts last year.

Many real estate market participants' hopes for an increase in the number of transactions this year are linked to expectations of lower interest rates. One of the main reasons for the decline in the number of transactions and affordability indicators was the sharp rise in interest rates from mid-2022. However, market participants saw the light at the end of the tunnel at the end of last year. The peak in interest rates is behind us, and the critical question now is at what pace the European Central Bank will cut interest rates this year.

Market expectations of the pace of interest rate cuts are too optimistic. Futures show that the market expects the three-month EURIBOR rate to be 2.5% at the end of this year, compared to 3.9% at present,“ the economist analysed.

SEB Group economists believe that the European Central Bank will cut the base rate four times this year, from 4 to 3 per cent.

The Bank's economist noted that house prices were stable in the last quarter of 2023, with a marginally positive annual price change.

„Admittedly, the forecast of those surveyed at the end of 2022, who said that house prices would remain unchanged in 2023, was the most confirmed. Of course, price changes have been uneven across different housing sectors. For example, prices of non-new housing did not decrease last year.

However, the prices of new economy-class housing have fallen slightly, especially when considering gifts or extra money offered by developers to buyers. Interestingly, the average price of apartments in Vilnius listed on the classified’s portal Aruodas rose significantly in December last year. This is either due to a change in the structure of housing supply or to sellers' desire to take advantage of the increased optimism about falling interest rates,“ he said.

According to Mr Povilauskas, the number of transactions decreased while prices remained stable, showing that there were still no crucial reasons to make sellers rush to sell their homes and thus reduce their prices.

At the same time, the financial situation of the population in Lithuania has remained stable, their expectations are optimistic, purchasing power has started to grow again, and the situation in the labour market is quite good. On the other hand, as the economist wrote, this year will not be easy because of the economy; the geopolitical situation is not improving, and this uncertainty does not give much reason to expect potential homebuyers to rush to decide on buying a home.

„House price expectations may improve in the first quarter of this year, but, as mentioned above, the market needs to keep expectations of the European Central Bank's interest rate changes in check. In addition, developments in the economic situation at the beginning of the year and the evolution of the labour market are also significant. The situation of exporting companies is unlikely to improve at the beginning of the year, and wage increases for the population are likely to be lower this year than last year.

The number of housing transactions in the first quarter of this year will be historically low but quite similar to last year. Housing prices are also likely to remain stable, and we can probably expect more significant changes as the year progresses“, T. Povilauskas concluded his review.